QuickBooks is the one of the world’s leading accounting software, but it can be overwhelming to learn for the beginner. Our course provides a step by step guide for setting up general information, such as creating a new company and preparing invoices. Utilizing plenty of visuals and screenshots, our QuickBooks 2015 course demonstrates how to use this popular business finance program to gain a clear view of your finances and keep your business running smoothly.

* You have 4 weeks to complete this course from date of your enrollment.

QuickBooks Pro 2015 course content

The QuickBooks Pro 2015 course consists of 4 modules:

QuickBooks 2015 Module 1 Chapters 1 - 3 Getting Started with QuickBooks

Before you can start using QuickBooks, you must first decide which edition is best for the size and scope of your company. An overview of several desktop editions of QuickBooks will be provided as well as how to create a new company and how to set up accounting and checking preferences. Module one will also look at creating customer profiles and listing inventory and products.

- QuickBooks Editions

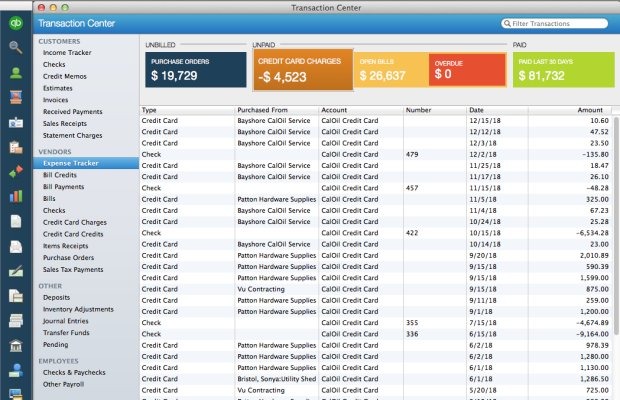

- Using the Customer and Vendor Center

- Setting up Accounting and Checking Preferences

- Opening an Existing Company

- Select Icon Bars

QuickBooks 2015 Module 2 Chapters 4 - 7 Payroll and Taxes

In module one, you were given an overview of how to use the customer and vendor center. Module two provides a more detailed look into setting preferences, creating job types, setting up payment methods and creating shipping methods. Ensuring proper payroll and tax records are kept are vital for any company to succeed. Module two will show you how to set up payroll options, process W-2s and summarize payroll data in Excel.

- Creating Vendor Types

- Setting up Payroll

- Creating an Employee Record

- Taxes and W-2s

- Payroll Liabilities

QuickBooks 2015 Module 3 Chapters 8 - 11 Bills and Bank Accounts

Module three is all about accounting, bills and recording payments. In order to operate a business professionally and efficiently, you must know how to accurately record payments and create invoices. This module focuses on working with estimates, managing vendor bills and manage inventory. You will also be introduced with how to handle and resolve discrepancies and how to reconcile a bank statement.

- Making Bank Deposits

- Create Invoices from Sales

- Duplicate an Estimate

- Write and Print Checks

- Moving Funds Between Accounts

QuickBooks 2015 Module 4 Chapters 12 - 15 Managing QuickBooks Data

Module four takes a look at a few different things. Some new techniques to assist in performing general tasks, such as viewing transaction details and deleting or voiding a transaction are provided. Customizing the appearance and behavior of QuickBooks is also introduced, such as setting up To Do notes, reminder notifications, and working with form templates. Finally, module four discusses how to back up your data and set up security preferences for added business security.

- Verify or Rebuild Data

- Set up Desktop View Preferences

- Find and Print Reports

- Work with a List Window

- Total Customization

After completing the QuickBooks Pro 2015 course

After completing this course, you should be able to:

- Identify the basics for getting started with QuickBooks

- Define the steps for completing daily entry tasks

- Recognize the steps to print checks, process taxes, process payroll, and track expenses

- Identify the steps for working with reports

- Identify steps for creating charts for tracking actual spending, income, inventory, assets, and liabilities

Course duration

The QuickBooks Pro 2015 course is 24 hours long, taught over 4 weeks.